The Basic Principles Of Broker Mortgage Rates

Wiki Article

An Unbiased View of Broker Mortgage Meaning

Table of ContentsThe Buzz on Broker Mortgage FeesThe Buzz on Broker Mortgage FeesThe Ultimate Guide To Mortgage Broker SalaryNot known Facts About Broker Mortgage RatesThe smart Trick of Mortgage Broker Vs Loan Officer That Nobody is Talking AboutThe 8-Second Trick For Broker Mortgage RatesHow Mortgage Brokerage can Save You Time, Stress, and Money.The Greatest Guide To Broker Mortgage Meaning

What Is a Mortgage Broker? A mortgage broker is an intermediary in between a banks that supplies car loans that are secured with realty as well as individuals curious about buying realty that require to borrow cash in the kind of a funding to do so. The home mortgage broker will deal with both events to obtain the specific approved for the finance.A mortgage broker normally works with several different lending institutions and also can offer a selection of car loan choices to the borrower they work with. The broker will accumulate information from the specific and go to multiple lending institutions in order to find the best potential car loan for their customer.

Facts About Mortgage Broker Job Description Uncovered

The Base Line: Do I Need A Home Loan Broker? Working with a home mortgage broker can conserve the customer effort and time during the application procedure, and possibly a great deal of money over the life of the funding. On top of that, some lenders function exclusively with home loan brokers, meaning that customers would have accessibility to car loans that would otherwise not be offered to them.It's essential to examine all the charges, both those you could have to pay the broker, along with any type of costs the broker can assist you avoid, when weighing the choice to function with a home loan broker.

See This Report on Broker Mortgage Meaning

You have actually probably heard the term "mortgage broker" from your property representative or close friends that have actually bought a home. What precisely is a mortgage broker and also what does one do that's different from, claim, a finance policeman at a bank? Geek, Pocketbook Overview to COVID-19Get response to concerns regarding your mortgage, travel, funds and preserving your assurance.What is a home loan broker? A home mortgage broker acts as an intermediary between you as well as possible lending institutions. Home loan brokers have stables of loan providers they work with, which can make your life less complicated.

Some Known Factual Statements About Mortgage Broker Job Description

Exactly how does a mortgage broker get paid? Home loan brokers are most typically paid by lenders, often by debtors, yet, by regulation, never ever both.The competitiveness as well as house prices in your market will certainly contribute to dictating what home mortgage brokers cost. Federal legislation limits just how high compensation can go. 3. What makes home loan brokers different from Homepage finance policemans? Loan policemans are employees of one lending institution who are paid established salaries (plus content bonus offers). Financing officers can create only the kinds of financings their employer selects to offer.

Mortgage Broker Job Description Can Be Fun For Everyone

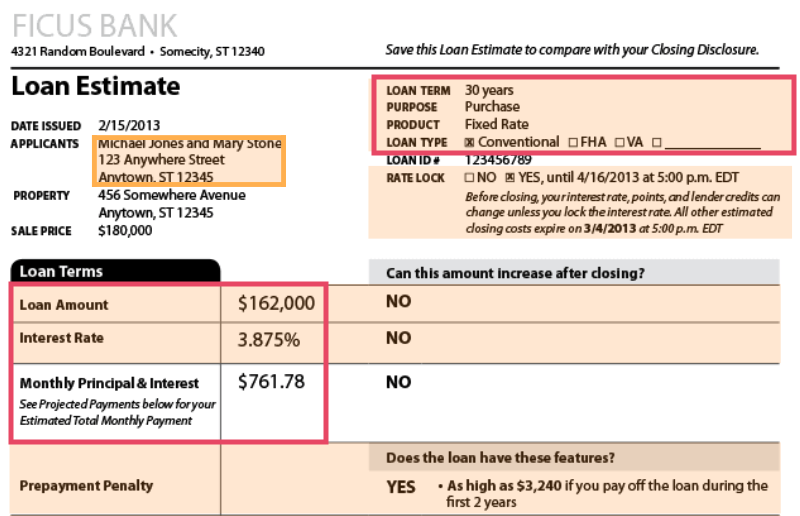

Home mortgage brokers may be able to give debtors access to a broad choice of car loan kinds. You can conserve time by making use of a mortgage broker; it can take hrs to apply for preapproval with various lending institutions, then there's the back-and-forth interaction entailed in underwriting the finance and ensuring the deal remains on track.When choosing any type of lender whether through a broker or directly you'll desire to pay focus to loan provider fees." Then, take the Financing Quote you obtain from each loan provider, position them side by side as click here now well as compare your interest price as well as all of the fees as well as closing prices.

10 Easy Facts About Mortgage Broker Explained

5. Exactly how do I choose a home mortgage broker? The very best means is to ask pals and family members for references, but ensure they have actually used the broker as well as aren't simply dropping the name of a previous university roommate or a distant colleague. Find out all you can about the broker's services, interaction style, level of understanding and approach to customers.

Getting My Mortgage Broker Meaning To Work

Competitors and residence rates will affect how much home mortgage brokers obtain paid. What's the distinction between a mortgage broker as well as a finance officer? Mortgage brokers will deal with numerous lenders to locate the most effective loan for your situation. Lending policemans help one lender. Just how do I discover a home mortgage broker? The most effective way to locate a home loan broker is with references from family, friends as well as your property agent.

Getting My Mortgage Broker Vs Loan Officer To Work

Buying a new house is one of one of the most complicated events in an individual's life. Characteristic vary greatly in terms of design, facilities, school area and, naturally, the constantly crucial "area, place, place." The home loan application procedure is a difficult element of the homebuying process, specifically for those without previous experience.

Can determine which issues might develop problems with one lending institution versus an additional. Why some customers stay clear of home loan brokers Occasionally property buyers really feel extra comfy going directly to a big bank to secure their loan. In that case, purchasers ought to a minimum of talk with a broker in order to understand all of their options relating to the sort of financing and the readily available rate.

Report this wiki page